“During the year we continued to outperform the world’s other major exchanges in attracting international IPOs, making very good progress in regions such as Latin America and the Middle East, where we have been less active historically. And we continue to pursue longer term prospects with the development of AIM Italia and our joint venture with the Tokyo Stock Exchange. Changes to the listing regime and the launch of the Specialist Fund Market have also increased the choice of routes to market for investment entities, and have firmly established our credentials as a leading venue for quoted alternative investment vehicles.”

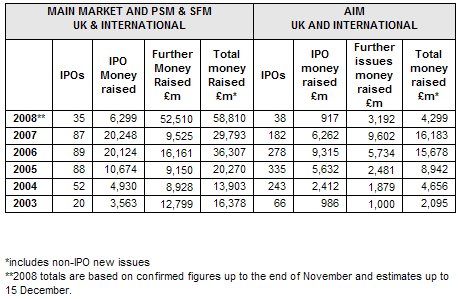

73 IPOs were conducted on the Main Market, Specialist Fund Market, Professional Securities Market and AIM during the year to 15 December, raising £7.2 billion in total. The Exchange confirmed its position as the world’s most international capital market, attracting 25 international IPOs, raising £3.5 billion between them. This compared with only 13 international IPOs on the New York Stock Exchange and Nasdaq combined.

2008 EQUITY MARKET HIGHLIGHTS

Middle East

The Exchange had a very good year in the Middle East, helping eight companies from the region to raise a combined £1.5 billion on joining the Exchange’s markets. The companies included three from Kuwait and two from Qatar, including the Exchange’s first ever IPOs from those countries, as well as one each from Dubai, Egypt and Bahrain. In addition, the world’s first ETF to offer access to Kuwait, the Lyxor ETF Kuwait (FTSE Coast Kuwait 40) was admitted to trading on the London Stock Exchange’s Main Market on 29 July.

Russia and Eastern Europe

On 22 April, the number of companies from Russia and the CIS quoted on the London Stock Exchange’s markets reached 100 when Magnit complemented its existing listings on RTS and Micex with a GDR issue on the London Stock Exchange’s Main Market which raised $239 million.

Also in May, New World Resources, a coal producer operating in the Czech Republic and Central Europe, raised £1.3 billion on the Main Market.

Latin America

On 14 May silver miner Fresnillo became the first company from Mexico to join the London Stock Exchange’s markets when it was admitted to trading on the Main Market, raising £913.3 million.

India

KSK Emerging India Energy Fund joined AIM on 10 June, raising £101.0 million. It was one of the largest AIM floats of the year. KSK was also one of four India-based firms to float on AIM in a four week period, raising approximately £196.1 million between them.

Investment Entities

Da Vinci CIS Private Sector Growth Fund became the first investment entity to join the Specialist Fund Market, the London Stock Exchange’s new market for alternative investment vehicles, raising $110 million on 29 May. The strength of the Exchange’s offering for investment entities was underlined by the successful IPO of BH Global Limited, a newly established feeder fund investing in Brevan Howard Global Opportunities Master Fund which commenced unconditional dealing the same day, and raised £533.8 million through a listing on the London Stock Exchange’s Main Market.

During the course of the year, Boussard and Gavaudan, and MW Tops, which had previously floated elsewhere, both took advantage of the updated listing rules for investment entities and joined the Exchange’s Main Market in order to benefit from the liquidity and profile that a listing in London offers.