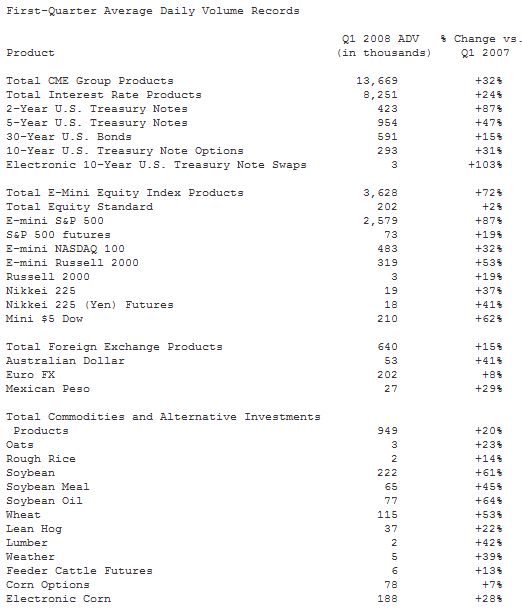

First-Quarter Highlights

All CME Group major product lines achieved quarterly volume records. CME Group E-mini equity index volume averaged a record 3.6 million contracts per day, up 72 percent compared with first-quarter 2007. CME Group interest rate volume averaged a record 8.3 million contracts per day, up 24 percent. CME Group commodities and alternative investments volume averaged a record 949,000 contracts per day, up 20 percent. CME Group foreign exchange (FX) volume averaged a record 640,000 contracts per day, up 15 percent from same period in 2007, and representing a notional value of $87 billion.

Record quarterly NYMEX energy and metals volume on the CME Globex trading platform increased 51 percent to average more than one million contracts per day for the first time. Legacy e-CBOT products reached a record 3.9 million contracts per day during the first quarter of trading on CME Globex. Both 5-Year U.S. Treasury Note and 30-Year U.S. Bond volume reached quarterly records following tick size adjustments that went into effect on March 3, up 47 percent and 15 percent respectively compared to the same period in 2007.

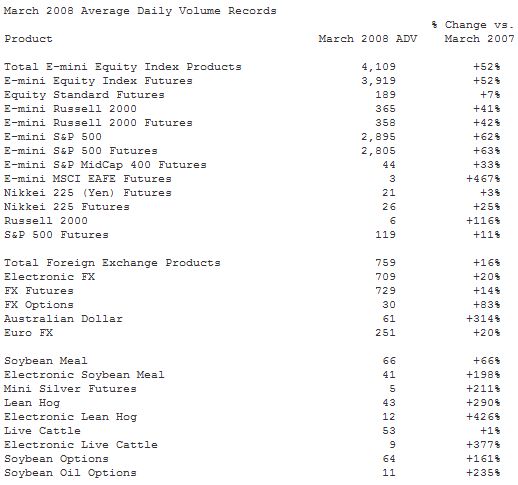

March 2008 Highlights

CME Group E-mini equity index volume averaged a record 4.0 million contracts per day, up 52 percent compared with March 2007. CME Group FX volume averaged a record 759,000 contracts per day, up 16 percent from the same period in 2007, and representing a notional value of $109 billion. CME Group commodities and alternative investments volume averaged 903,000 contracts per day, up 23 percent. CME Group interest rate volume averaged 7.5 million contracts per day, up 2 percent from March 2007. Record monthly NYMEX energy and metals volume on the CME Globex trading platform increased 71 percent to average more than 1.1 million contracts per day.