Dividend Trade Activity

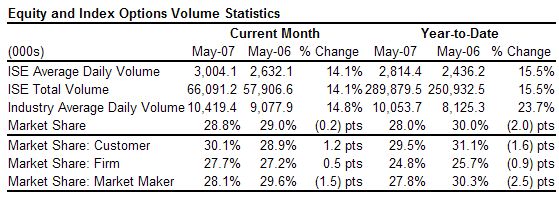

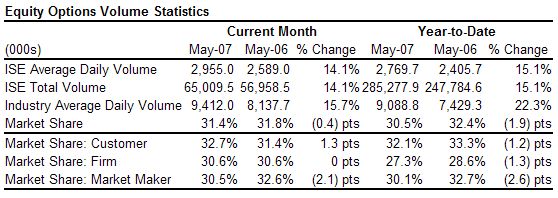

Our market share statistics continue to be negatively impacted by trading activity related to dividend trades among certain options market makers. These trades temporarily inflate and distort trading volume and market share when transacted. If the volume from the largest dividend trades were excluded from the data, our market share of equity options for the month of May would increase to 32.2% from 31.4%, an increase of 0.8 market share points.

On a year-to-date basis, our market share would increase to 31.5% from 30.5%, an increase of 1.0 market share point, if the volume from the largest dividend trades were excluded. The exclusion of dividend trades from total industry volume data presents a more relevant measure of the relative trends in our business.

Monthly Highlights

* Average daily volume of equity and index options contracts surpassed the 3 million mark for the first time in ISE’s history.

* ISE was the largest U.S. equity options exchange in May.

* On May 8, 2007, ISE announced the addition of four new board members. Joseph Stefanelli and Kenneth Vecchione joined the Board of Directors of International Securities Exchange Holdings, Inc. and International Securities Exchange, LLC (ISE LLC). Leonard Ellis and Randy Frederick joined the ISE LLC Board as representatives of ISE LLC's Competitive Market Makers (CMMs) and Electronic Access Members (EAMs), respectively. The new board members are replacing Ivers Riley, Mark Kritzman, James Harkness and William Porter, who are retiring from their respective Boards due to term limits.

* On May 8, 2007, ISE’s Board of Directors declared a quarterly dividend of $0.05 per outstanding share of Class A Common Stock. The dividend is payable on June 29, 2007 to holders of record as of the close of business on June 22, 2007.

* On May 10, 2007, ISE announced that its Board of Directors elected two new officers. Thomas Reina was appointed as Technology Development Officer and John Ryan as Technology Architecture Officer.

* On May 18, 2007, ISE co-sponsored the NYU conference “Derivatives 2007: New Ideas, New Instruments, New Markets” where leading academics and industry practitioners examined the links between modern derivatives theory and market practice.

* ISE traded more volume than any other options exchange in 941 of 1,735 issues in its listings.