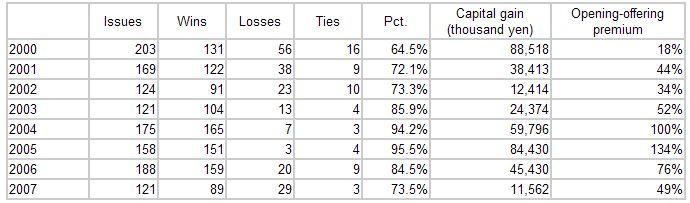

In 2007, there was an average premium of 49% for IPO opening prices compared with the offering prices. Although the opening price premium is not particularly low compared with other years since 2000, stock prices of 2007 IPOs were often very weak afterward. As of December 29, 76 of the 121 IPOs in 2007, which is about two-thirds, were trading below their offering prices. Moreover, only 29 of these issues were trading above their opening prices. That means investors who were fortunate enough to buy a 2007 IPO at the offering price would in most cases be losing money if they still held the stock at the end of 2007. For investors who bought a 2007 IPO at the opening price and still held the stock, there would be only a 24% probability of having an unrealized capital gain. Consequently, market activity in 2007 provided investors with no incentive to use IPOs for long-term investments.

For 2008, the key point will be whether or not securities companies can once again make IPOs appealing to investors who are now shunning these issues.

As I just explained, the number of IPOs in 2008 will probably be smaller than in 2007. Only companies that can meet today’s stringent standards will be able to list their shares. That means we can expect to see a big improvement in the quality of companies going public.

More specifically, I believe that companies will require the following three attributes in order to pass stock exchange listing examinations.

1) Sound corporate governance

2) Skill in creating business plans

3) A timely financial disclosure program (quarterly earnings reports)

Because of this higher quality, there will probably be fewer companies in 2008 than in 2007 that see their stock prices fall below the offering prices. One point warrants particular attention. I think we are very likely to see a decline with respect to the above three points at many companies that conducted IPOs within about the past two years. Furthermore, I think that independent accountants will be reluctant to work with these companies. For these kinds of companies, investors should conduct a thorough investigation rather than making a purchase simply because a stock appears to be inexpensive. Otherwise, investors may end up holding a stock for a long time as they wait for the price to return to the purchase price.

When investing in an IPO stock, I recommend that investors focus on the above three points and buy only after a stock has been trading for a while. Looking at the 2007 IPOs, there were almost no stocks that climbed steadily following the listing date. Therefore, investors who bought at the offering price should consider selling after trading begins and then buying the stock back at a lower level afterward.

Another approach is to wait for the one or two issues usually occur each year that are suitable for a long-term investment. Growth prospects should not be the basis for this selection. Instead, I think investors should look for midsize or large companies that already have a solid position in their respective markets. These companies can become a core holding of the investor’s stock portfolio. Stocks like this will rebound after a while even if there is a big drop in the stock market. These are the companies that I recommend.

During the past years, individual investors have experienced the frustration of seeing prices drop immediately after a purchase or buying a stock when it’s down and then waiting in vain for a rebound. As a result, many individuals are probably afraid to touch an IPO. But I believe this situation will not last long.

Investors should realize that a time like this when IPO sentiment is extremely negative is actually an outstanding opportunity to earn profits. I recommend that investors adopt this approach when considering IPO investments in 2008.