NASDAQ's matched market share in NYSE-listed securities was 14.5% in February compared to 14.9% in January and 7.0% in February 2006. NASDAQ's touched market share in NYSE-listed securities was 33.9% in February compared to 35.8% in January and 17.6% February 2006. During February 2007, NASDAQ's average daily total share volume in NYSE-listed securities was approximately 954 million, compared with 988 million in January and 497 million in February 2006.

As expected, NASDAQ matched and touched market share in NYSE-listed securities experienced a decline as a result of NASDAQ's migration to the new Single Book system. NASDAQ has seen market share improvement in March as firms' trading behaviors adjust to the new Single Book.

NASDAQ's total market share in NYSE-listed securities in February was 33.3% compared with 33.3% in January and 21.4% in February 2006. Included in the total market share figure for February is 18.8% in NYSE-listed securities executed by broker-dealers and reported to systems operated by NASDAQ.

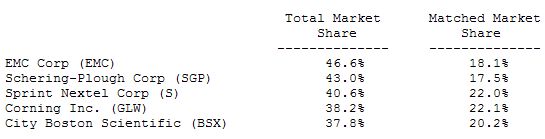

The table below shows NASDAQ's market share in several individual NYSE-listed securities during February:

For the month, NASDAQ achieved total market share of over 30% in 297 NYSE-listed companies priced over $10 with average daily trading volume of more than 1 million shares. NASDAQ's market share in the following 47 companies was over 40%:

Pengrowth Energy Trust (NYSE:PGH), Anixter International Inc. (NYSE:AXE), Realogy Corp. (NYSE:H), Canetic Resources Trust (NYSE:CNE), Yamana Gold Inc. (NYSE:AUY), Silver Wheaton Corp. (NYSE:SLW), OSI Restaurant Partners Inc. (NYSE:OSI), Interpublic Group Of Cos. (NYSE:IPG), Phelps Dodge Corp. (NYSE:PD), Equity Office Properties Tr (NYSE:EOP), Archer Daniels Midland Co. (NYSE:ADM), Caremark Rx Inc. (NYSE:CMX), Systemax Inc. (NYSE:SYX), Fannie Mae (NYSE:FNM), EMC Corp. (NYSE:EMC), Fording Canadian Coal Trust (NYSE:FDG), Sabre Holdings Corp. (Cl A) (NYSE: TSG), Advanced Micro Devices Inc. (NYSE:AMD), American Oriental Bioengineering Inc. (NYSE:AOB), Banco Bilbao Vizcaya Argentaria S.A. (ADS) (NYSE: BBV), Medtronic Inc. (NYSE:MDT), Windstream Corp. (NYSE:WIN), Harrah's Entertainment Inc. (NYSE:HET), Laidlaw International Inc. (NYSE:LI), Titanium Metals Corp. (NYSE:TIE), Goodyear Tire & Rubber Co. (NYSE:GT), Schering-Plough Corp. (NYSE:SGP), King Pharmaceuticals Inc. (NYSE:KG), Pfizer Inc. (NYSE:PFE), CapitalSource Inc. (NYSE:CSE), AGCO Corp. (NYSE:AG), ArvinMeritor Inc. (NYSE:ARM), First American Corp. (NYSE:FAF), American Tower Corp. (NYSE:AMT), Clear Channel Communications Inc. (NYSE: CCU), Terra Industries Inc. (NYSE:TRA), CMS Energy Corp. (NYSE:CMS), Micron Technology Inc. (NYSE:MU), Service Corp. International (NYSE:SCI), CVS Corp. (NYSE:CVS), CenterPoint Energy Inc. (NYSE:CNP), Warner Music Group Corp. (NYSE:WMG), Sprint Nextel Corp. (NYSE:S) New Plan Excel Realty Trust Inc. (NYSE:NXL), Elan Corp. PLC (ADS) (NYSE:ELN), Trinity Industries Inc. (NYSE:TRN), Sara Lee Corp. (NYSE:SLE).

Total market share in NASDAQ-listed securities increased to 76.0% in February from 73.0% in January. Included in the total market share figure for February is 32.2% in NASDAQ securities executed by broker-dealers and reported to the NASD/NASDAQ Trade Reporting Facility (TRF), a facility of NASD that is operated by NASDAQ, compared to 28.2% in January.

Matched market share in NASDAQ-listed securities in February was 43.8% compared to 44.8% in January. NASDAQ's touched market share in NASDAQ-listed securities in February was 48.1% compared to 48.9% the previous month.

"Total market share" in NASDAQ-listed securities is based on all share volume reported to the consolidated tape using NASDAQ-operated systems. This includes total share volume of NASDAQ-listed securities that are executed on The NASDAQ Stock Market LLC, NASDAQ's recently launched national securities exchange, plus trades reported through the NASD/NASDAQ Trade Reporting Facility (TRF), a facility of NASD that is operated by NASDAQ, as a percentage of total consolidated NASDAQ market volume. Shares routed to other market centers for execution are not included in "total market share." This data is single counted.

"Total market share" in NYSE-listed securities is based on total share volume of NYSE-listed securities that are executed on the NASDAQ Market Center and the INET book, plus trade reported volume as a percentage of total consolidated NYSE market volume.

"Total market share" in all U.S. Equity securities is based on total share volume of NASDAQ-, NYSE-, Amex-, and regional exchange-listed securities that are executed on the NASDAQ Market Center and the INET book, plus trade reported volume as a percentage of total consolidated NASDAQ-, NYSE-, Amex-, and regional exchange-listed market volume.

Matched market share represents total share volume of NASDAQ or NYSE-listed securities that are executed on the NASDAQ Market Center and the INET book as a percentage of total consolidated NASDAQ or NYSE market volume.

Touched market share represents total share volume of NASDAQ or NYSE-listed securities that are executed on the NASDAQ Market Center and the INET book, plus volume of shares routed to other market centers for execution as a percentage of consolidated NASDAQ or NYSE market volume.