Operating income was $68.1 million for the fourth quarter of 2006, an increase of $34.9 million, or 105.1% when compared to $33.2 million for the fourth quarter of 2005, and up slightly from $67.9 million for the third quarter 2006. Operating income for the full year was $214.1 million, an increase of 88.3% when compared to $113.7 million for the full year 2005.

Gross margin, representing total revenues less cost of revenues, was $183.1 million in the fourth quarter of 2006, an increase of 32.1% from $138.6 million in the year-ago period, and up 7.0% from $171.2 million reported in the third quarter of 2006. Gross margin for the full year 2006 was $687.4 million, an increase of 30.7% from $526.0 million in 2005.

“Our strong financial results point to the success that we achieved in 2006,” commented NASDAQ's Chief Executive Officer, Robert Greifeld. “During the year we began operations as a national securities exchange, completed the migration of Nasdaq-listed stocks to a single trading platform, increased our share of U.S. equity trading and initial public offerings, and continued to increase the value proposition for listing on NASDAQ by offering more products and services.

Mr. Greifeld concluded, “We enter 2007 with a stronger core business that will support our new growth initiatives to increase revenue and profitability. We plan to achieve this by gaining market share and through new initiatives such as our planned options exchange and Portal market.”

Recent Highlights

-Achieved new market share highs in trading NYSE- and Amex-listed stocks. Matched market share for NYSE-listed stocks increased in December 2006 to 14.2%, up from 5.5% in December 2005. Matched market share for AMEX-listed stocks increased to 24.6% in December 2006, up from 19.7% in December 2005.

-Completed the migration to our single book platform for Nasdaq-listed securities, providing market participants with a deeper liquidity pool, improved system performance and greater order interaction.

-Continued success in obtaining switches from other markets, with 94 companies transferring their listing to NASDAQ during the year.

-Redeemed the Series D preferred stock that had been issued to NASD. NASD no longer maintains voting control over NASDAQ.

-Fully integrated the newly acquired press release newswire service, PrimeNewswireSM.

Charges Associated with NASDAQ's Cost Reduction Program and INET Integration

Included in total expenses for the fourth quarter 2006 are pre-tax charges of $4.6 million relating to NASDAQ's continuing efforts to reduce operating expenses and improve the efficiency of its operations, as well as to integrate INET. These charges include:

Technology Review – NASDAQ recorded expenses of $3.3 million in the quarter associated with its technology review, in which it previously changed the estimated useful life of some assets as it migrates to lower cost operating platforms and processes.

Workforce Reductions - NASDAQ recorded charges of $1.3 million in the quarter for severance and outplacement costs.

NASDAQ's Chief Financial Officer, David Warren, commented: “During the year we continued to demonstrate our ability to effectively integrate acquisitions while driving innovation and growth in our core businesses. The fourth quarter 2006 represents an impressive string of nine consecutive quarters of sequential top-line growth for NASDAQ. Operating margins also improved, with operating income for 2006 increasing by 88.3% when compared to the prior year. This consistent record of performance improvement highlights our ability to compete effectively in a rapidly changing marketplace.”

Q4 Financial Review

Total Revenues and Gross Margin –Gross margin increased 32.1% in the fourth quarter to $183.1 million, up from $138.6 million in the year-ago quarter, and up 7.0% from $171.2 million reported in the third quarter of 2006.

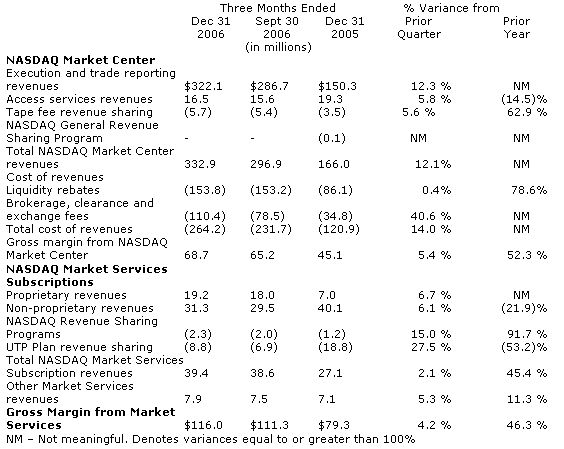

Market Services

Market Services gross margin increased to $116.0 million, or 46.3%, from prior year, and increased 4.2% from prior quarter.

NASDAQ Market Center gross margin increased from the year-ago quarter primarily because of INET results, increases in average daily trading volume, and increases in trade execution market share for NYSE- and AMEX-listed equities. INET is included in NASDAQ results as of the date of closing, December 8, 2005. Access services revenue declined from the year-ago quarter due to the retirement of legacy products in December 2005. Increases from prior quarter are primarily related to higher trading volume and new fees for inbound orders. Beginning October 1, 2006 the SEC permitted exchanges to charge for inbound orders that remove liquidity via the Intermarket Trading System (ITS). Access services increases from prior quarter are due to higher customer demand.

Market Services Subscriptions revenues increased from the year-ago quarter as less data revenue was shared under the UTP Plan. NASDAQ's UTP market share increased primarily due to the INET acquisition which resulted in INET trades being reported to NASDAQ. Also, effective February 7, 2006, NASDAQ was no longer required to share NQDS revenue, thereby reducing the amount of revenue shared with UTP Plan participants. This change is also the primary driver for the growth in proprietary revenues and the decline in non-proprietary revenues when compared to the year-ago quarter. Increases from prior quarter are primarily due to higher Total View and Level 1 subscriber populations, offset somewhat by higher UTP Plan revenue sharing due to declines in market share of Nasdaq-listed securities.

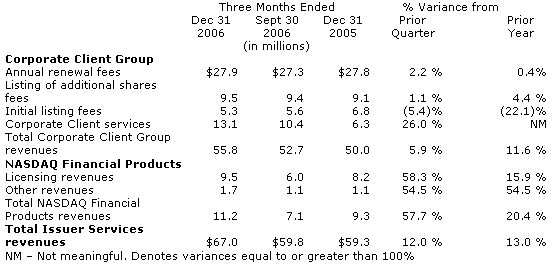

Issuer Services

During the quarter Issuer Services revenues increased 13.0% to $67.0 million from the prior year quarter and increased 12.0% from prior quarter.

Corporate Client Group revenues increases from prior year and prior quarter are driven primarily by revenues generated from recent acquisitions, which are included in the Corporate Client services line.

NASDAQ Financial Products licensing revenues increased from the prior year and prior quarter due to the collection of licensing revenue for options on ETFs that track NASDAQ indexes. As previously reported, the recent outcome of two court cases has impacted NASDAQ's ability to collect licensing revenue for options traded on NASDAQ ETF's. However a portion of the licensing revenue was recognized during the fourth quarter of 2006.

Total Expenses

Total expenses increased 9.1% to $115.0 million from $105.4 million in the year-ago quarter and increased 11.3% from $103.3 million in the prior quarter. Fourth quarter 2006 expenses increased from last year primarily due to the recent acquisitions of INET, Shareholder.com, and PrimeNewswire. Expenses increased from third quarter 2006 primarily due to the integration of PrimeNewswire, higher marketing and advertising spending, and higher professional services costs, offset somewhat by lower depreciation expenses.

Gain on Foreign Currency Option Contracts

Included in non-operating income in the fourth quarter 2006 is an unrealized pre-tax gain of $48.4 million ($29.4 net of tax) on foreign currency option contracts purchased to hedge the foreign exchange exposure on the acquisition bid for The London Stock Exchange. This gain had the effect of increasing diluted earnings per share by $0.19. On February 12, 2007, in conjunction with the lapse of our final offer for The London Stock Exchange, NASDAQ traded out of these foreign exchange contracts. Due to the improving exchange rate of the dollar when compared to the pound sterling, NASDAQ will be recording a pre-tax loss of approximately $7.8 million on these foreign currency option contracts in first quarter 2007 results. The cumulative realized pre-tax gain on the foreign currency option contracts is approximately $40.6 million.

Dividend Income

Included in non-operating income in the fourth quarter and full year 2006 is dividend income of $7.0 million and $16.2 million, respectively, representing ordinary dividends declared by the London Stock Exchange during 2006.

Earnings Per Share

As stated above, fourth quarter earnings per diluted share was $0.43 versus $0.15 per diluted share in the year-ago quarter and $0.22 in the third quarter of 2006. NASDAQ's weighted average shares outstanding used to calculate diluted earnings per share was 152.1 million in the quarter versus 122.5 million in the year-ago quarter and 150.8 million in the third quarter 2006. The outstanding share count increased from the year-ago quarter primarily due to the issuance of approximately 26.5 million shares in equity offerings in the first and second quarters of 2006.