NASDAQ continued to capture a greater percentage of market share in NYSE-listed securities. Matched market share in NYSE-listed securities increased to 14.9% in January from 14.2% in December and 6.2% in January 2006. NASDAQ's touched market share in NYSE-listed securities rose to 35.8% in January from 33.3% in December and 16.1% January 2006. During January 2007, NASDAQ's average daily total share volume in NYSE-listed securities was approximately 988 million, compared with 779 million in December and 552 million in January 2006.

NASDAQ's total market share in NYSE-listed securities in January was 33.3% compared with 31.9% in December and 21.7% in January 2006. Included in the total market share figure for January is 18.4% in NYSE-listed securities executed by broker-dealers and reported to systems operated by NASDAQ.

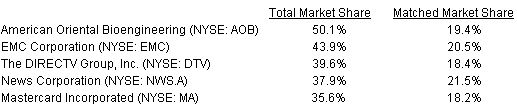

The table below shows NASDAQ's market share in several individual NYSE-listed securities during January:

For the month, NASDAQ achieved total market share of over 30% in 255 NYSE-listed companies priced over $10 with average daily trading volume of more than 1 million shares. NASDAQ's market share in the following 42 companies was over 40%:

Hertz Global Holdings, Inc. (NYSE: HTZ), Provident Energy Trust (NYSE: PVX), Kinder Morgan, Inc. (NYSE: KMI), Interpublic Group of Companies, Inc. (NYSE: IPG), Pengrowth Energy Trust (NYSE: PGH), Yamana Gold Inc. (NYSE: AUY), Canetic Resources Trust (NYSE: CNE), American Oriental Bioengineering, Inc. (NYSE: AOB), Schering-Plough Corporation (NYSE: SGP), Sabre Holdings Corporation (NYSE: TSG), Silver Wheaton Corp. (NYSE: SLW), Sprint Nextel Corporation (NYSE: S), Equity Office Properties Trust (NYSE: EOP), Advanced Micro Devices, Inc. (NYSE: AMD), Conseco, Inc. (NYSE: CNO), Louisiana-Pacific Corporation (NYSE: LPX), CMS Energy Corporation (NYSE: CMS), Xcel Energy Inc. (NYSE: XEL), Motorola, Inc. (NYSE: MOT), CVS Corporation (NYSE: CVS), King Pharmaceuticals, Inc. (NYSE: KG), Red Hat, Inc. (NYSE: RHT), Ceridian Corporation (NYSE: CEN), EMC Corporation (NYSE: EMC), Jacuzzi Brands, Inc. (NYSE: JJZ), AmeriCredit Corp. (NYSE: ACF), Clear Channel Communications, Inc. (NYSE: CCU), Caremark Rx, Inc. (NYSE: CMX), Medtronic, Inc. (NYSE: MDT) , AGCO Corporation (NYSE: AG), Ryerson Inc. (NYSE: RYI), Time Warner Inc. (NYSE: TWX) , Mellon Financial Corporation (NYSE: MEL), Pfizer Inc. (NYSE: PFE), Duke Energy Corporation (NYSE: DUK), The Goodyear Tire & Rubber Company (NYSE: GT), Advanced Medical Optics, Inc. (NYSE: EYE), Allied Capital Corporation (NYSE: ALD), Alcatel-Lucent (ADR) (NYSE: ALU), Headwaters Incorporated (NYSE: HW), Halliburton Company (NYSE: HAL), Citizens Communications (NYSE: CZN) .

Total market share in NASDAQ-listed securities was 73.0% in January compared to 74.6% in December. Included in the total market share figure for January is 28.2% in NASDAQ securities executed by broker-dealers and reported to the NASD/NASDAQ Trade Reporting Facility (TRF), a facility of NASD that is operated by NASDAQ, compared to 28.0% in December.

Matched market share in NASDAQ-listed securities in January was 44.8% compared to 46.6% in December. NASDAQ's touched market share in NASDAQ-listed securities in January was 48.9% compared to 50.7% the previous month.

“Total market share” in NASDAQ-listed securities is based on all share volume reported to the consolidated tape using NASDAQ-operated systems. This includes total share volume of NASDAQ-listed securities that are executed on The NASDAQ Stock Market LLC, NASDAQ's recently launched national securities exchange, plus trades reported through the NASD/NASDAQ Trade Reporting Facility (TRF), a facility of NASD that is operated by NASDAQ, as a percentage of total consolidated NASDAQ market volume. Shares routed to other market centers for execution are not included in “total market share.” This data is single counted.

“Total market share” in NYSE-listed securities is based on total share volume of NYSE-listed securities that are executed on the NASDAQ Market Center and the INET book, plus trade reported volume as a percentage of total consolidated NYSE market volume.

“Total market share” in all U.S. Equity securities is based on total share volume of NASDAQ-, NYSE-, Amex-, and regional exchange-listed securities that are executed on the NASDAQ Market Center and the INET book, plus trade reported volume as a percentage of total consolidated NASDAQ-, NYSE-, Amex-, and regional exchange-listed market volume.

Matched market share represents total share volume of NASDAQ or NYSE-listed securities that are executed on the NASDAQ Market Center and the INET book as a percentage of total consolidated NASDAQ or NYSE market volume.

Touched market share represents total share volume of NASDAQ or NYSE-listed securities that are executed on the NASDAQ Market Center and the INET book, plus volume of shares routed to other market centers for execution as a percentage of consolidated NASDAQ or NYSE market volume.