The merger between NYSE, Inc. and Archipelago Holdings, Inc. was completed on March 7, 2006 . As such, first quarter 2006 results include the full quarter results from the operations of NYSE, Inc., the predecessor of NYSE Group, and the operations of NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange) since March 8, 2006.

Included in results for the first quarter of 2007 are $11.1 million in merger expenses consisting of professional and other fees incurred in connection with both the acquisition of the Archipelago businesses and the recently completed combination with Euronext N.V. ($4.6 million), and exit costs associated with the previously announced trading floor consolidation ($6.5 million).

On a non-GAAP basis, giving effect to the Archipelago merger as if it occurred at the beginning of the earliest period presented, and excluding the merger and exit costs, the net income of NYSE Group for the three months ended March 31, 2007 would have been $74.2 million, or $0.47 per diluted share, a $21.2 million or 40.0% increase as compared to net income, on a non-GAAP basis, of $52.9 million, or $0.34 per diluted share, for the three months ended March 31, 2006. A full reconciliation of these non-GAAP results is included in the attached tables.

“As we transition from NYSE Group into the newly-formed NYSE Euronext, the world’s largest and most diverse exchange group, we continue to develop our multinational business model to enhance our listings and equities trading operations, and support our growing initiatives in derivatives, bonds, options and ETFs,” said NYSE Euronext Chief Financial Officer, Nelson Chai. “NYSE Euronext is committed to providing exceptional shareholder value while expanding upon our position as the first global marketplace group, further evidenced by this quarter’s announcements of our purchase of a 5% stake in India’s National Stock Exchange and our strategic alliance with the Tokyo Stock Exchange.”

“As we work towards the realization of our integration targets with Euronext, we will further enhance our value proposition to investors and listed companies by offering the ability to trade and list the widest range of products in multiple time zones and currencies, leverage our unique advantages as an operator of six exchanges in five countries, and deliver on our well defined cost savings and revenue synergies of $375 million over the next three years.”

Other Financial Highlights

* Excluding the effect of activity assessment fees and Section 31 fees, the pre-tax margin of NYSE Group on a non-GAAP basis was 24.3% of total revenues for the three months ended March 31, 2007 as compared to 21.9% of total revenues for the three months ended March 31, 2006 .

* NYSE Group’s financial results reflect its focus on delivering against the cost saving targets established in conjunction with the merger of NYSE and Archipelago. Fixed operating expenses (defined as operating expenses excluding Section 31 fees, liquidity payments, and routing and clearing fees) on a non-GAAP basis for the first quarter of 2007 were $229.0 million, a $56.7 million or 20% decrease versus the first quarter of 2006.

* For the three months ended March 31, 2007 , NYSE Group’s compensation expense included a $12.8 million non-recurring gain related to the elimination of certain employee post retirement benefits. This non-recurring gain partially offset $15.2 million in charges incurred by NYSE Group for the routing of customer orders from the NYSE to other market centers for the period from January 2 through March 2, 2007 . Commencing March 5, 2007 , consistent with industry practice, the NYSE implemented new routing fees to mitigate the expenses incurred from other market centers.

Business Highlights

* On April 4, 2007 , NYSE Group consummated its combination with Euronext N.V. creating NYSE Euronext (NYSE Euronext: NYX). As a world leader for listings, trading in cash equities, equity and interest rate derivatives, bonds and the distribution of market data, NYSE Euronext offers the most diverse array of financial products and services combined with the highest standards of market quality for all market participants.

* On April 4, 2007 , NYSE Group acquired a 5% equity position in the Mumbai-based National Stock Exchange of India Limited (NSE), India' s leading cash equities, derivatives and fixed income exchange.

* On January 31, 2007, NYSE Group signed a letter of intent with the Tokyo Stock Exchange (TSE) establishing a strategic alliance exploring specific areas of mutual interest, including: information and market infrastructure systems and technology, trading services, market data products, issuer and investor services, cross-marketing and promotional activities, and listed company regulation and governance.

* NYSE Arca Options introduced new options pricing in conjunction with the SEC penny pilot program that began January 26, 2007 . Rewarding participants that improve market quality and provide liquidity, the new NYSE Arca model offers increased efficiency and economic benefits to the growing options industry. In the SEC penny pilot program, NYSE Arca Options has shown a 38% increase in its share of trading in the pilot options through April 24, 2007 and reached an all time volume high, trading over 1 million electronic contracts on February 27, 2007. NYSE Arca Options executes nearly 70% of its total volume in the pilot program electronically, up from 46% prior to the pilot, demonstrating the speed and flexibility of its new platform.

* The NYSE launched its next generation fixed-income trading platform, NYSE Bonds®on April 23, 2007 . The all-electronic NYSE Bonds® platform maintains and matches orders on a strict price and time priority basis and reports quotations and trade prices on an absolute real-time basis using NYSE Arca’s order matching engine. NYSE Bonds® plans to add up to 6,000 corporate debt issues to its inventory over time.

* During the first quarter of 2007, NYSE Group completed the full implementation of the NYSE Hybrid MarketSM and became fully Regulation NMS compliant. To date, NYSE Hybrid MarketSM has demonstrated faster order executions, strong fill rates, and industry-leading market quality. With approximately 20% of share volume currently handled through trading-floor brokers utilizing new NYSE Hybrid MarketSM electronic tools, the new system has tightened quoted spreads, while maintaining the deep liquidity associated with the NYSE auction market model.

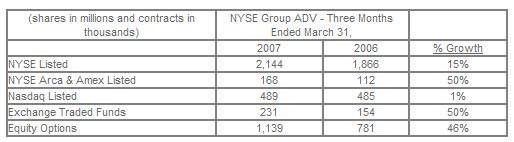

* Handled average daily volumes (ADV) increased in every product category traded by NYSE Group during the first quarter of 2007 versus the comparable period in 2006.

* As of March 31, 2007 , NYSE Group listed a total of 178 ETFs, representing over 56% of the assets under management for all ETFs traded in the U.S. NYSE Group listed 41 new ETFs in the first quarter 2007 and handled nearly 45% of all ETF shares traded in the U.S.

* In the first quarter of 2007, the NYSE had 72 new listings, including six IPOs by US domestic operating companies (excluding closed-end funds). Among these IPOs was Fortress Investment Group, Inc., which raised over $2 billion in proceeds.

* Closed-end funds on the NYSE raised record proceeds in the first quarter of 2007 with more than $10 billion in new equity. On February 23, 2007 , the largest-ever closed-end fund offering, the Eaton Vance Tax-Managed Global Diversified Equity Income Fund (NYSE: EXG) raised $5.5 billion in gross proceeds in connection with its listing on the NYSE. The prior record was set by the Alpine Total Dynamic Dividend Fund (NYSE: AOD), which raised $3.5 billion when listing on the NYSE in January 2007.

* During the first quarter of 2007, American Eagle, Petrohawk, Navios Maritime and Washington Group International transferred from Nasdaq to the NYSE. On April 18, 2007 , Darwin Professional Underwriters celebrated its transfer to the NYSE, one year after it went public and listed on NYSE Arca.

* On March 28, 2007 , NYSE Group launched the NYSE Arca Tech 100 ETF (NYSE Arca: NXT), which is based on the price-weighted NYSE Arca Tech 100 index, a widely recognized benchmark for the technology sector. NXT is sponsored and managed by Ziegler Capital Management, LLC.

* The NYSE Composite (NYA), the flagship index of the NYSE, reached 11 new highs during the first quarter of 2007, and increased 6.2% over the same period a year ago.