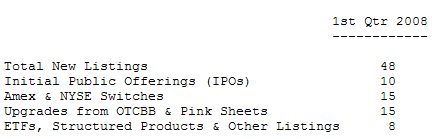

NASDAQ continued to capture more new listings than any other U.S. exchange, as measured by the total number of issues. During the first quarter, NASDAQ captured 48 new listings, comprised of the following categories:

Of the 15 IPOs in the first quarter that were eligible to list on NASDAQ or any listing market of the NYSE Group, approximately sixty-seven percent chose to list on NASDAQ.

Notable listings in the first quarter included the top 10 IPOs, as measured by proceeds raised, of Danvers Bancorp, Inc. (Nasdaq:DNBK), CardioNet, Inc. (Nasdaq:BEAT), Meridian Interstate Bancorp, Inc. (Nasdaq:EBSB), IPC The Hospitalist Company, Inc. (Nasdaq:IPCM), and Cape Bancorp, Inc. (Nasdaq:CBNJ) and the switches from the American Stock Exchange (Amex) of Camden National Corporation (Nasdaq:CAC), Bolt Technology Corporation (Nasdaq:BOLT) and Mission West Properties, Inc. (Nasdaq:MSW).

NASDAQ saw six non-U.S. new listings in the first quarter, including the IPOs of Chinese educational services company ATA, Inc. (Nasdaq:ATAI), the Amex switch of Canadian international energy company Transglobe Energy Corporation (Nasdaq:TGA), and the Chinese Over-the-Counter Bulletin Board (OTCBB) upgrades of go-kart manufacturer Kandi Technologies, Corp. (Nasdaq:KNDI), film and packaging materials company Shiner International, Inc. (Nasdaq:BEST), steel fabrication company Sutor Technology Group Limited (Nasdaq:SUTR), and power generating company A-Power Energy Generation Systems, Ltd. (Nasdaq:APWR).

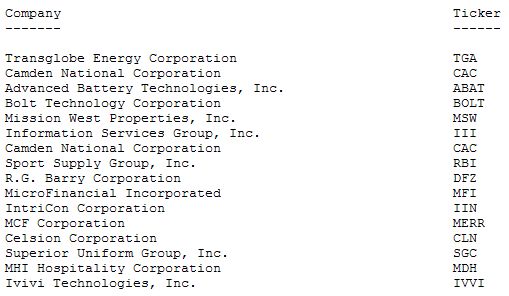

A record fifteen companies switched from the Amex, eleven of which elected to retain their three-character symbols. This was made possible by the Securities and Exchange Commission's (SEC) approval of a NASDAQ proposal in July 2007 to allow NASDAQ to accept three-character ticker symbols - in addition to the four-character symbols NASDAQ has historically used.

Below is a list of the Amex companies that switched to NASDAQ in the first quarter:

NASDAQ, the most liquid U.S. market for exchange traded funds (ETF), listed two new ETFs in the first quarter; BGI-sponsored iShares MSCI ACWI Index Fund (Nasdaq:ACWI) and iShares MSCI ACWI ex US Index Fund (Nasdaq:ACWX). They are trading on The NASDAQ ETF Market, which is designed specifically to support ETFs and Index Linked Notes (ILNs) during their critical period of incubation and further strengthen NASDAQ's leadership position in the U.S. ETF sector.